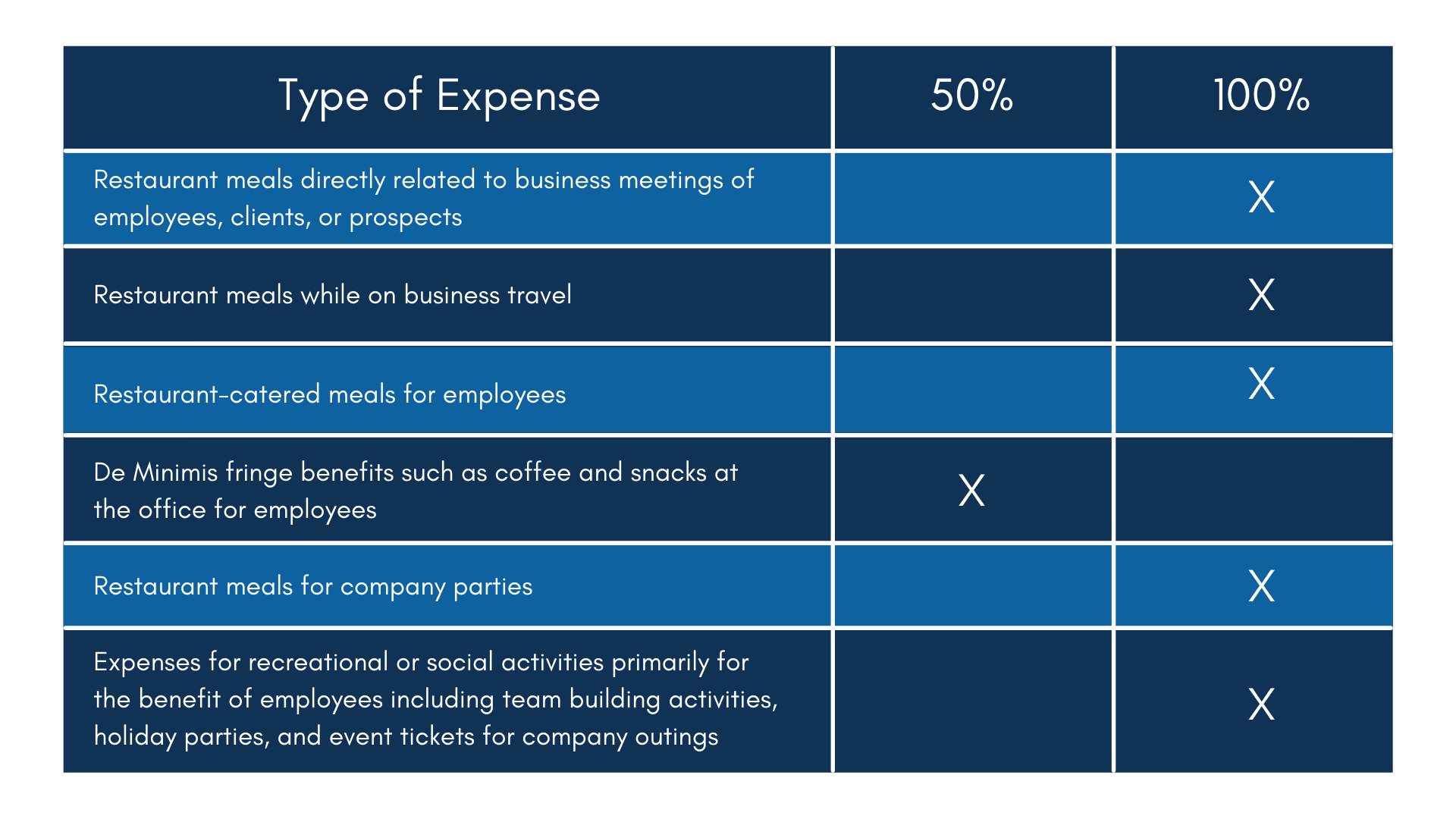

Meals And Entertainment Deduction Rules . it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. according to current irs rules, most business meals are still 50% deductible. Here’s what you need to know when it comes to these tax breaks. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. meals and entertainment expense deductions can be confusing — especially when rules and guidance. So, for example, if you take a prospective client out to a hip new lunch place. the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. the meals and entertainment deduction is changing in 2023. Keep reading for what you need to know about this valuable tax deduction.

from bh-co.com

according to current irs rules, most business meals are still 50% deductible. Keep reading for what you need to know about this valuable tax deduction. the meals and entertainment deduction is changing in 2023. it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. So, for example, if you take a prospective client out to a hip new lunch place. meals and entertainment expense deductions can be confusing — especially when rules and guidance. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. Here’s what you need to know when it comes to these tax breaks. refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients.

Meals & Entertainment Deductions What’s New for 2021 & 2022 Beaird

Meals And Entertainment Deduction Rules Keep reading for what you need to know about this valuable tax deduction. Here’s what you need to know when it comes to these tax breaks. meals and entertainment expense deductions can be confusing — especially when rules and guidance. Keep reading for what you need to know about this valuable tax deduction. it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. So, for example, if you take a prospective client out to a hip new lunch place. refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. according to current irs rules, most business meals are still 50% deductible. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. the meals and entertainment deduction is changing in 2023. the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted.

From flyfin.tax

Meals & Entertainment Deduction 2022 5 MustKnow Tips FlyFin Meals And Entertainment Deduction Rules the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. the meals and entertainment deduction is changing in 2023. refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. Keep reading for what you. Meals And Entertainment Deduction Rules.

From augustinawtiena.pages.dev

Meals And Entertainment Deduction 2024 Chart Esme Ofelia Meals And Entertainment Deduction Rules the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. Here’s what you need to know when it comes to these tax breaks. according to current irs rules, most business meals are still 50% deductible. the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted.. Meals And Entertainment Deduction Rules.

From www.simafinancialgroup.com

New Tax Law Takes a Bite out of Meals & Entertainment Deductions SIMA Meals And Entertainment Deduction Rules refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. meals and entertainment expense deductions can be confusing — especially when rules and guidance. the meals and entertainment deduction is changing in 2023. the 50% disallowance rule limits the business deduction for. Meals And Entertainment Deduction Rules.

From relayfi.com

Meals and Entertainment Deduction Rules for 2023 Onwards Meals And Entertainment Deduction Rules Here’s what you need to know when it comes to these tax breaks. it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. meals and entertainment expense deductions can be confusing — especially when rules and guidance. the meals and entertainment deduction is changing in 2023. the. Meals And Entertainment Deduction Rules.

From bh-co.com

Meals & Entertainment Deductions What’s New for 2021 & 2022 Beaird Meals And Entertainment Deduction Rules So, for example, if you take a prospective client out to a hip new lunch place. meals and entertainment expense deductions can be confusing — especially when rules and guidance. the meals and entertainment deduction is changing in 2023. Here’s what you need to know when it comes to these tax breaks. the meals and entertainment tax. Meals And Entertainment Deduction Rules.

From www.pkfmueller.com

Update On Deducting Business Meal And Entertainment Expenses PKF Mueller Meals And Entertainment Deduction Rules meals and entertainment expense deductions can be confusing — especially when rules and guidance. the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. Here’s what you need to. Meals And Entertainment Deduction Rules.

From taxedright.com

Meals and Entertainment Deduction 2022 Taxed Right Meals And Entertainment Deduction Rules refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. Here’s what you need to know when it comes to these tax breaks. it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. meals. Meals And Entertainment Deduction Rules.

From www.ggadvisorskc.com

Understanding business meal and entertainment deduction rules GG Meals And Entertainment Deduction Rules it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. Here’s what you need to know when it comes to these tax breaks. meals. Meals And Entertainment Deduction Rules.

From shaycpa.com

Meals and Entertainment Deduction Shay CPA Meals And Entertainment Deduction Rules the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. . Meals And Entertainment Deduction Rules.

From quizzcampuskendrick.z5.web.core.windows.net

Examples Of Meals And Entertainment Expenses Meals And Entertainment Deduction Rules according to current irs rules, most business meals are still 50% deductible. the meals and entertainment deduction is changing in 2023. Keep reading for what you need to know about this valuable tax deduction. the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. So, for example, if. Meals And Entertainment Deduction Rules.

From www.seldenfox.com

Understanding Business Meal and Entertainment Deduction Rules Selden Fox Meals And Entertainment Deduction Rules the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. Here’s what you need to know when it comes to these tax breaks. refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. it is the amount the company gives. Meals And Entertainment Deduction Rules.

From www.slideserve.com

PPT Guide on Business Meals and Entertainment Deduction PowerPoint Meals And Entertainment Deduction Rules Keep reading for what you need to know about this valuable tax deduction. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. meals and entertainment expense deductions can be confusing — especially when rules and guidance. Here’s what you need to know when it comes to these tax breaks. it is the amount. Meals And Entertainment Deduction Rules.

From shaycpa.com

Meals and Entertainment Deduction Shay CPA Meals And Entertainment Deduction Rules the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. the meals and entertainment deduction is changing in 2023. refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. So, for example, if you take a prospective client out to. Meals And Entertainment Deduction Rules.

From www.jbsmintaccounting.com

How The Meals And Entertainment Tax Deduction Works Meals And Entertainment Deduction Rules So, for example, if you take a prospective client out to a hip new lunch place. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. meals and entertainment expense deductions can be confusing — especially when rules and guidance. Here’s what you need to know when it comes to these tax breaks. the. Meals And Entertainment Deduction Rules.

From busacta.com

Confused with Meals and Entertainment Deductions? Meals And Entertainment Deduction Rules refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. Keep reading for what you need to know about this valuable tax deduction. So, for. Meals And Entertainment Deduction Rules.

From spiegel.cpa

2022 Meal & Entertainment Deductions Explained Spiegel Accountancy Meals And Entertainment Deduction Rules Here’s what you need to know when it comes to these tax breaks. Keep reading for what you need to know about this valuable tax deduction. it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. meals and entertainment expense deductions can be confusing — especially when rules and. Meals And Entertainment Deduction Rules.

From www.fuoco.cpa

Finally IRS Issues Final Rules on Meal and Entertainment Deduction Meals And Entertainment Deduction Rules according to current irs rules, most business meals are still 50% deductible. it is the amount the company gives to employees for their expenses on drinks, hotel stays, meals, movies, etc. Keep reading for what you need to know about this valuable tax deduction. refreshments or snacks for the public can be fully deductible if you can. Meals And Entertainment Deduction Rules.

From lanettewsofia.pages.dev

Irs Meals And Entertainment Deduction 2024 gnni harmony Meals And Entertainment Deduction Rules meals and entertainment expense deductions can be confusing — especially when rules and guidance. So, for example, if you take a prospective client out to a hip new lunch place. the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. the 50% disallowance rule limits the business deduction. Meals And Entertainment Deduction Rules.